At Tradesman Insurance 4u, we offer flexible options for over 350 different trades. Our policies can be customised to meet your specific needs, covering public liability, professional indemnity, employers liability, personal accident, product liability, and additional tool cover..

As a tradesman, you face a variety of risks and perils in your daily work. That's why we've partnered with top UK insurance providers to give you competitive prices and comprehensive coverage. With decades of experience working with tradesmen and construction professionals, we understand the challenges you face and strive to make insurance stress-free.

Tradesman insurance is designed to protect your business from high-risk situations. We make it easy for you to get covered with our simple online form, and our helpful advisors are available to discuss your options and help you determine the right level of cover for your business.

Our UK public liability insurance product ranges between £1 million and £10 million indemnity limit, depending on what suits you best. Don't let unexpected events impact your livelihood - get the insurance you need today.

You don't have to compromise on quality when you choose Tradesman Insurance 4U. We offer a range of public liability insurance policies to suit all trades and budgets. Our policies are comprehensive and affordable, complete our online form in 5 simple steps and we'll get straight to work, finding you the best possible quote to suit your needs.

Whether it's £1,000,000 or £10,000,000 you need, we've got you covered.

From professional indemnity insurance to additional tool cover, add all the cover you need with your public liability insurance in one quote form and we'll tailor your insurance policy to suit your needs.

Use our simple and secure online form to request your quote.

Get a quote with our online form in 6 simple steps. One policy, one set of documents.

Our UK based call centres are full of friendly staff who are here to help.

With over 30 years of experience, and only offering insurance from UK based A-rated insurers, you're in good hands.

These insurance products are designed to cover a firm for compensation and legal fees relating to injury to a member of the public relating to your business activities, or damage to their property.

For example, if a plumber is working on the central heating system of a household and does the job incorrectly, it could lead to severe water damage. The householder could make a claim for repairs needed after a flood caused by your company, and the public liability insurance package could cover this.

Public liability insurance is designed to:

Any company that regularly comes into contact with members of the public would be strongly advised to take out public liability insurance cover. If your business is sued for a client’s injury or damage to property the legal and compensation bill could be huge. Insurance may well be able to cover this. Firms should bear in mind that they could be liable whether the incident happens on their premises or at a site at which they are operating.

There is no legal requirement in the UK for a company to take out public liability insurance, but it is required under some client contracts, as some companies refuse to do business unless there is cover in place. Some professional bodies demand a minimum level of business insurance and regulators in some industries insist on it.

At Tradesman Insurance 4u, we understand that each trade and business is unique, and that's why we offer customisable insurance options to suit your individual needs. Whether you're a construction company owner, a freelance data analyst, or working from home, our tailored insurance policies provide the protection you need to secure your livelihood. Trust us to curate a comprehensive set of options that suit your business, so you can focus on what you do best. Contact us today for a personalised quote.

As soon as you decide to go ahead we'll send you full documentation and you'll have access to a of experienced insurance experts who will be on hand to assist you every step of the way. From smaller businesses to large companies, we'll find the right insurance solutions for you. Get latest industry updates from our tradesman blog and keep one step ahead of the competition. If you’re not sure where to start, you can first head to our tradesman insurance FAQ's and proceed to pick out a trade or insurance type that you want to be more informed about.

Tradesman Insurance 4u is dedicated to providing top-notch public liability insurance for tradesmen. We pride ourselves on offering a personalised 5-star service, with a wide range of options to suit your specific needs. Our goal is to make the insurance process simple and straightforward, so you can focus on your business with peace of mind. Get a quote today and experience our commitment to excellent customer service.

Be informed on what types of insurance you’ll need in order to sufficiently prepare yourself and your business to keep it running as smoothly as possible. Here are some important insurance policies you should consider:

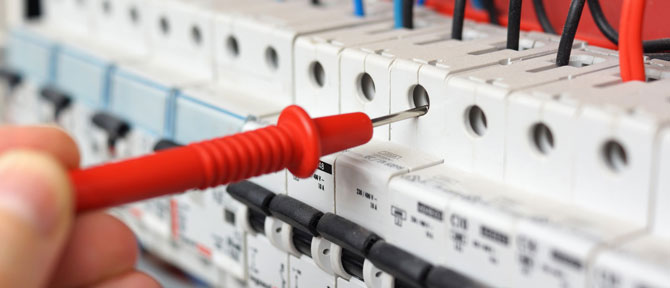

Electrical contractors are seemingly always in demand, we leave you to concentrate on what's important - your business - and take the stress out of insurance. Find out all you need to know.

Taking into consideration the hazardous nature of certain building projects, building contractors insurance really is a must-have.